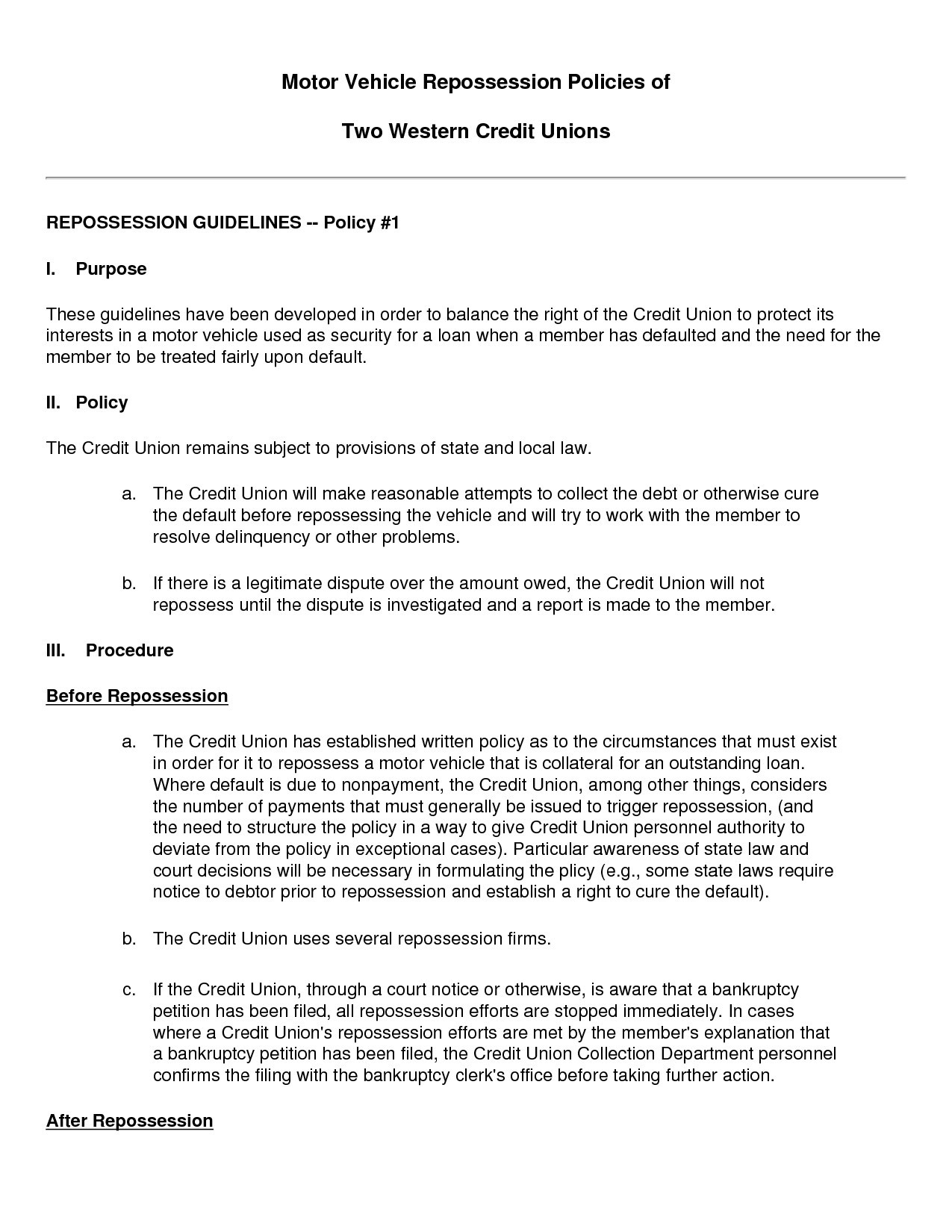

repossession dispute letter template – Kacor image source: kacor.tk

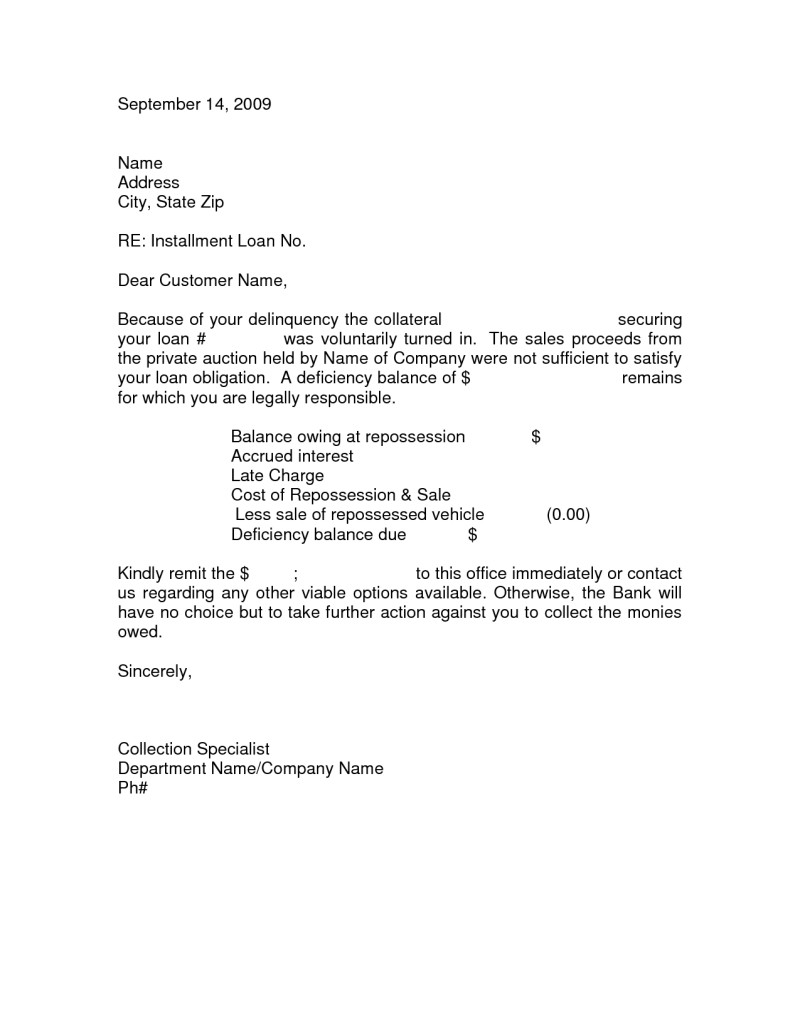

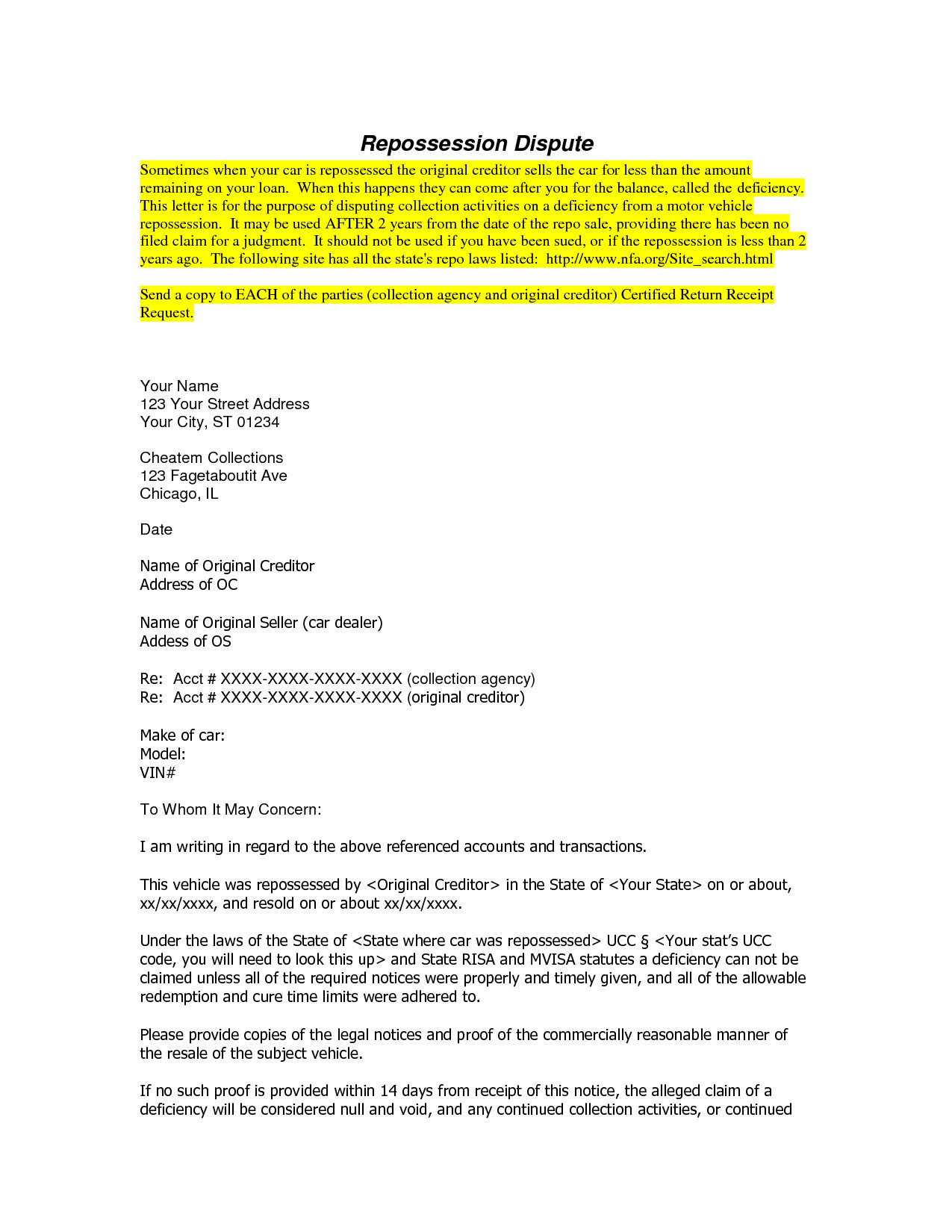

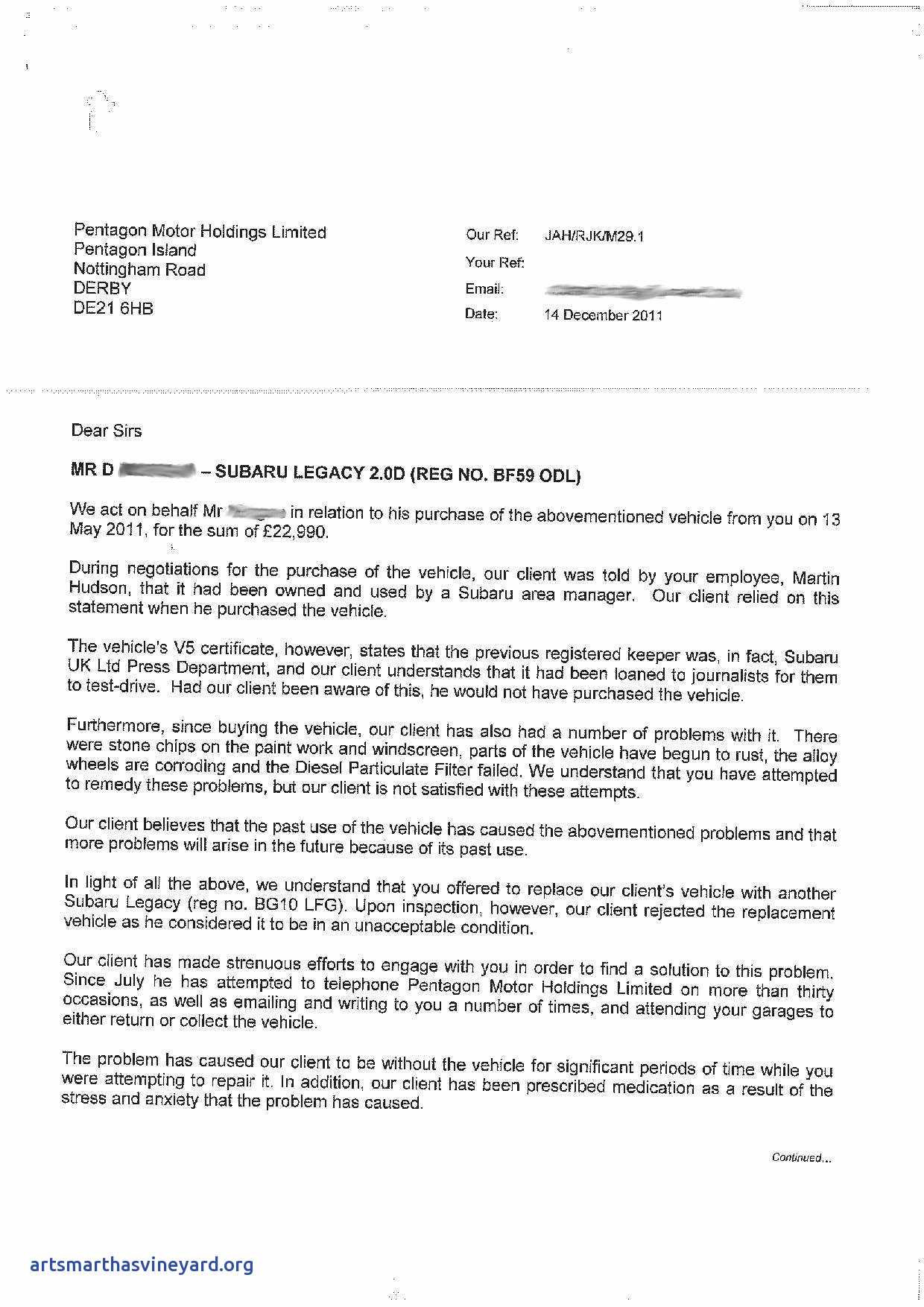

If you are looking for a car repossession letter template, this article will give you some information on the subject. A repossession letter is usually sent to a car owner who has defaulted on his or her car loan, or has had late payments on the loan, or if the borrower has declared bankruptcy. If you are having trouble paying your car loan, or if you just have not been keeping up with your monthly payments, your lender is going to want to get their money back, and they have several ways to do this.

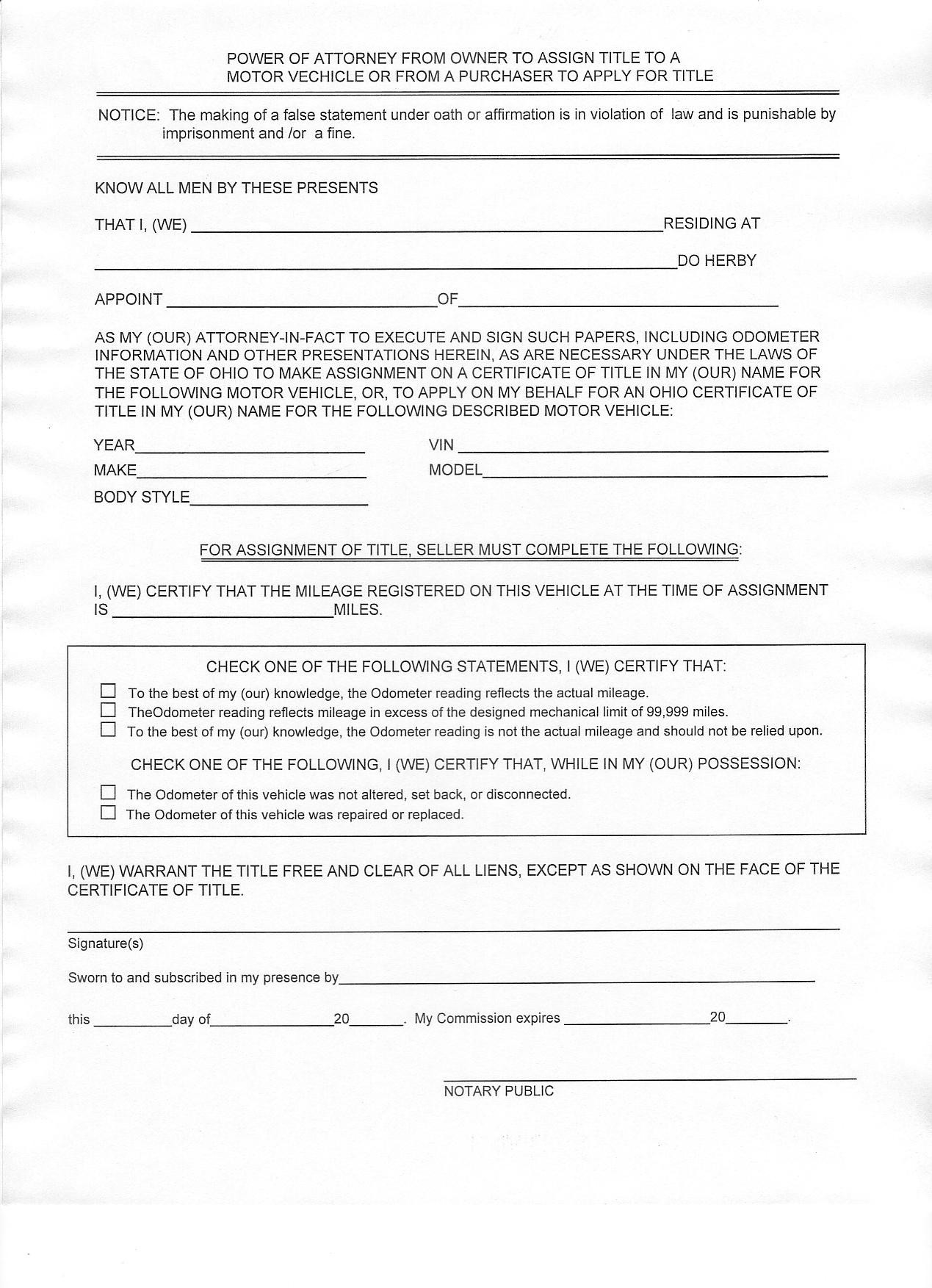

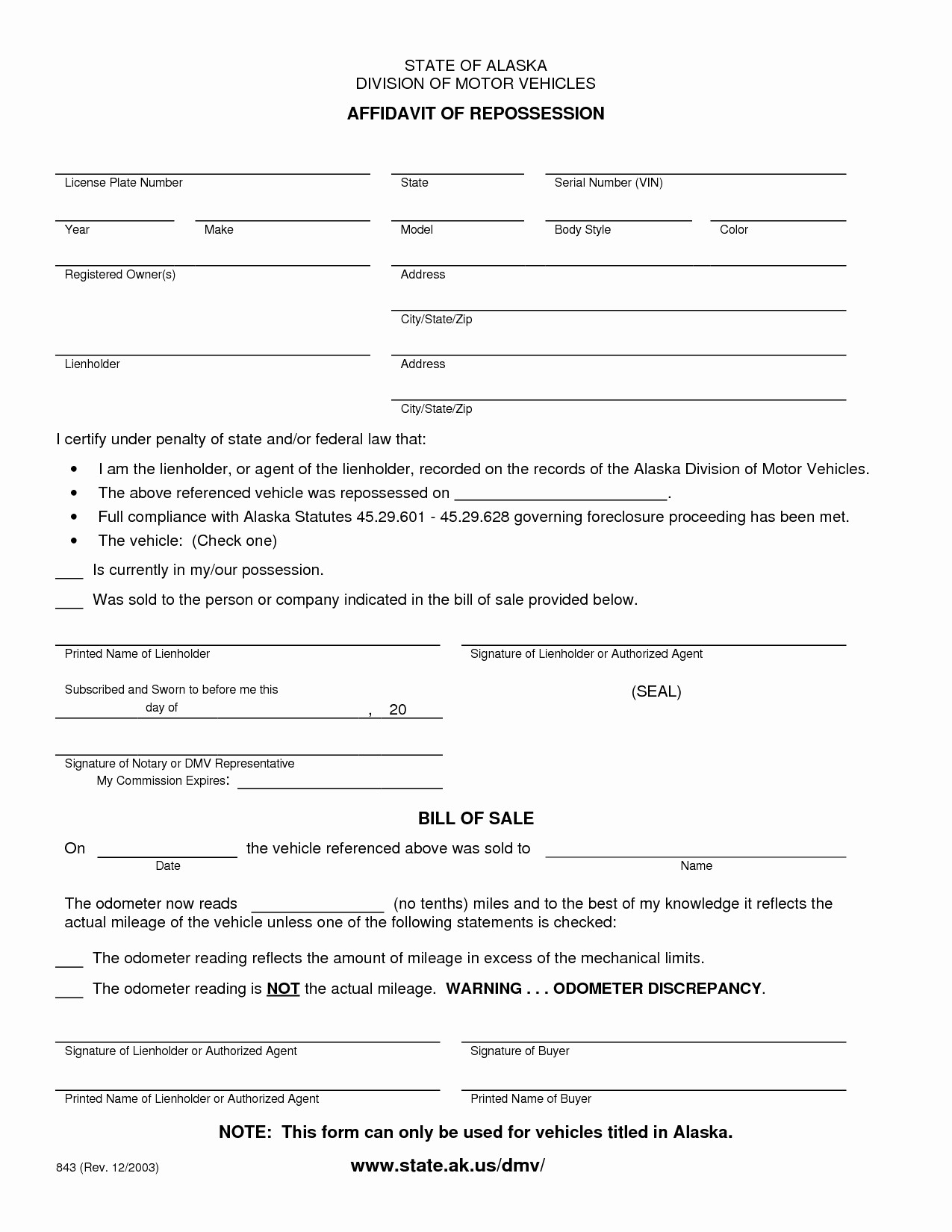

The most common way that the lender can repossess your car is by filing a lis pendens, which means a list of repossession. This is an order in court which states that you are liable for making all of your car loan payments, and the court has the power to force you to make those payments. The more payments that you miss, the higher your chances of having a lis pendens issued. Once it is issued, the lender can repossess your car at any time, and they can also seize your car if you do not pay off the debt as soon as possible.

There are also many other ways that your lender can repossess your car, and one of these methods is through the process of car repossession. This is when the car loan lender uses a repossession procedure to take your car from you. They have a list of things that they believe are owed to them by you, and they will use those things to get the car from you.

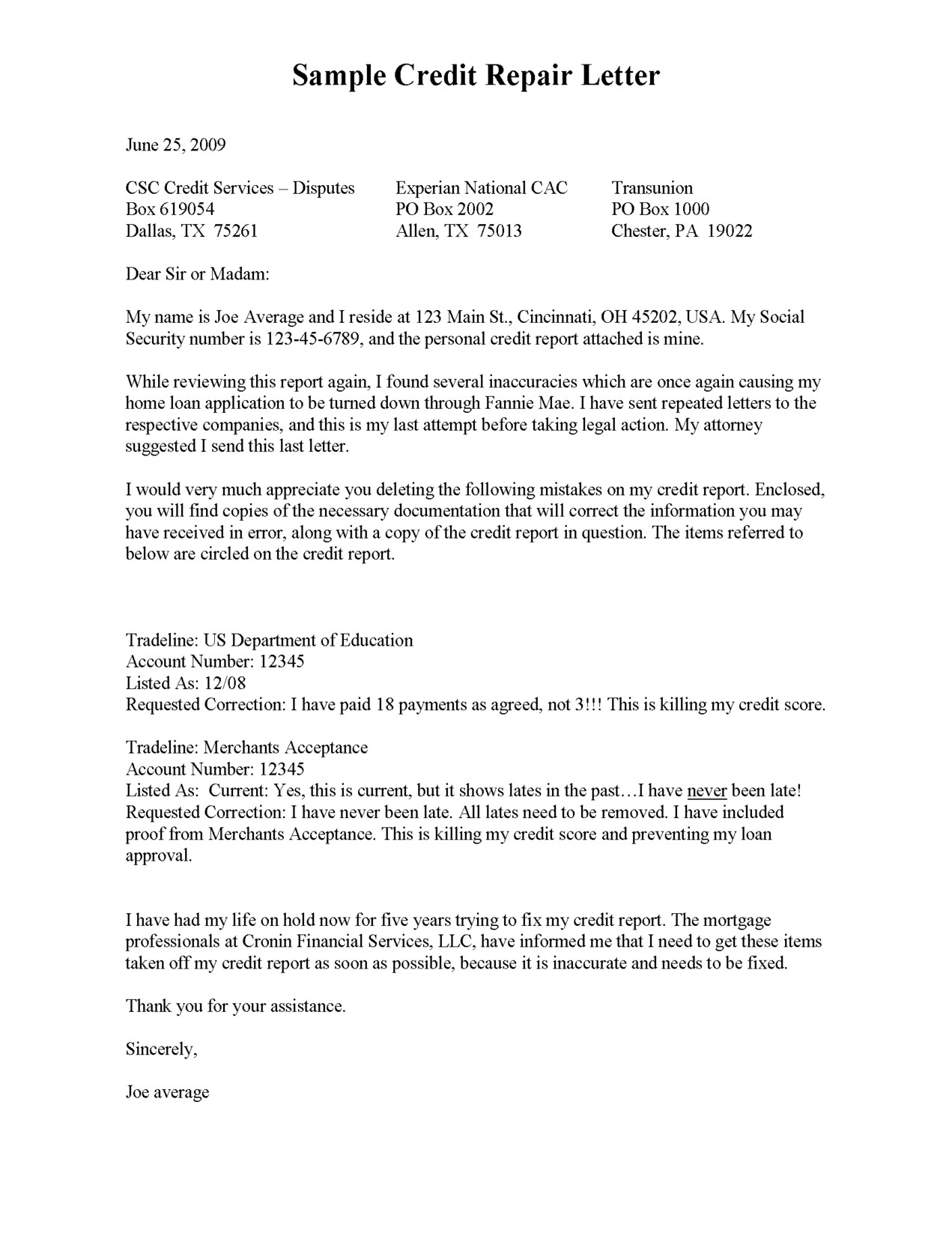

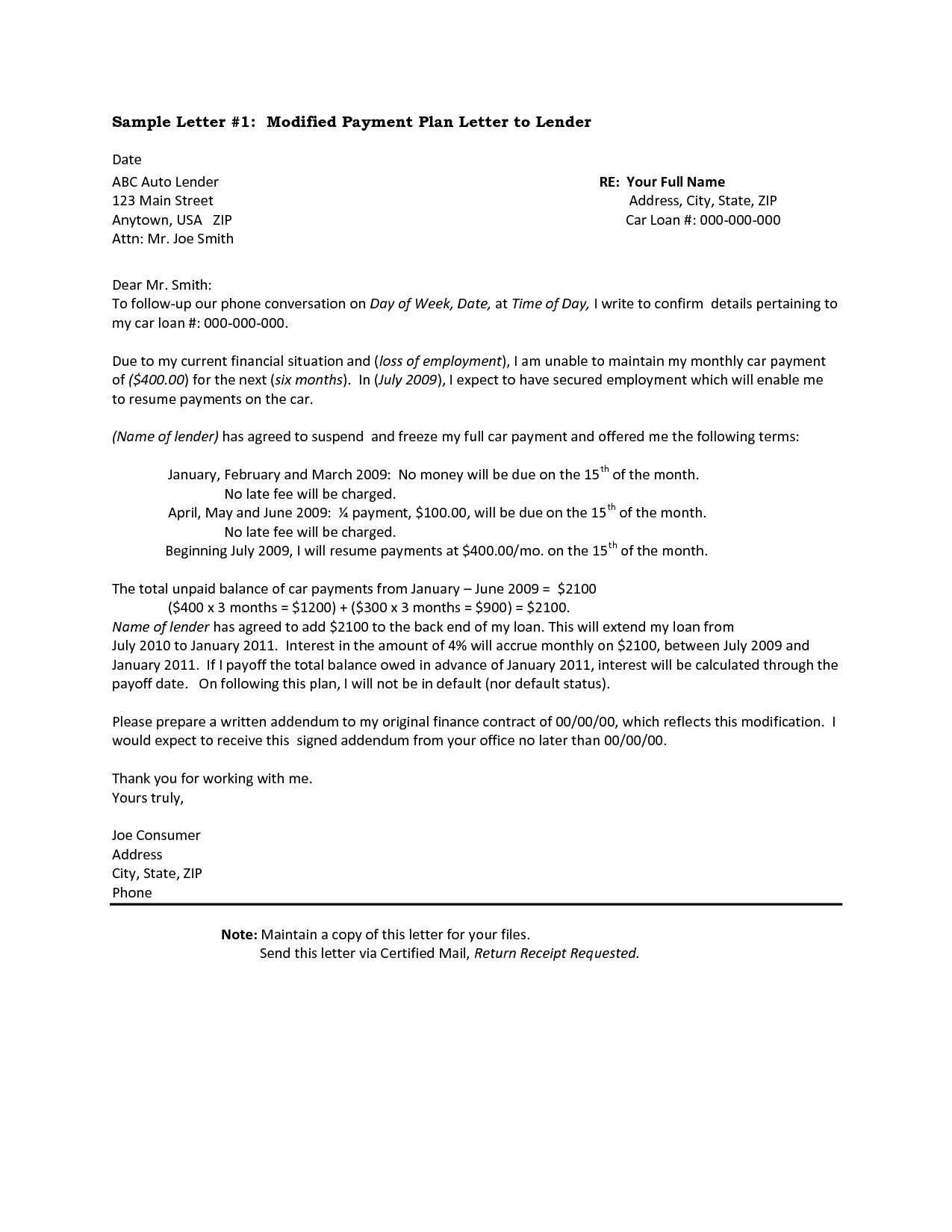

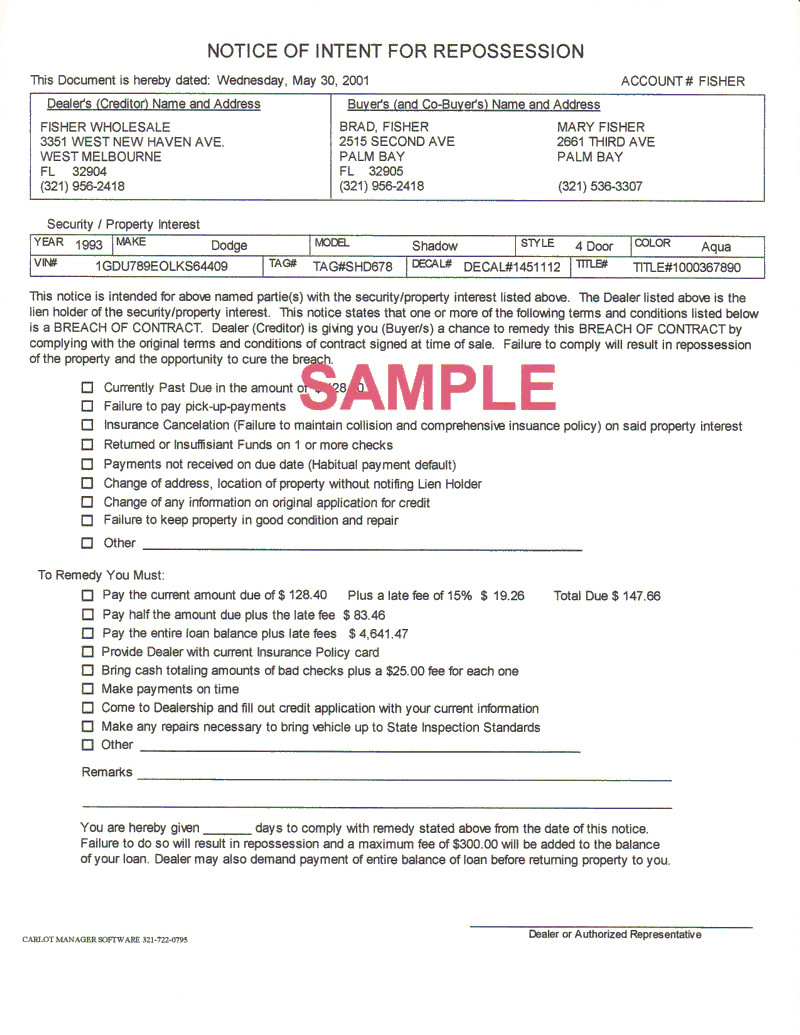

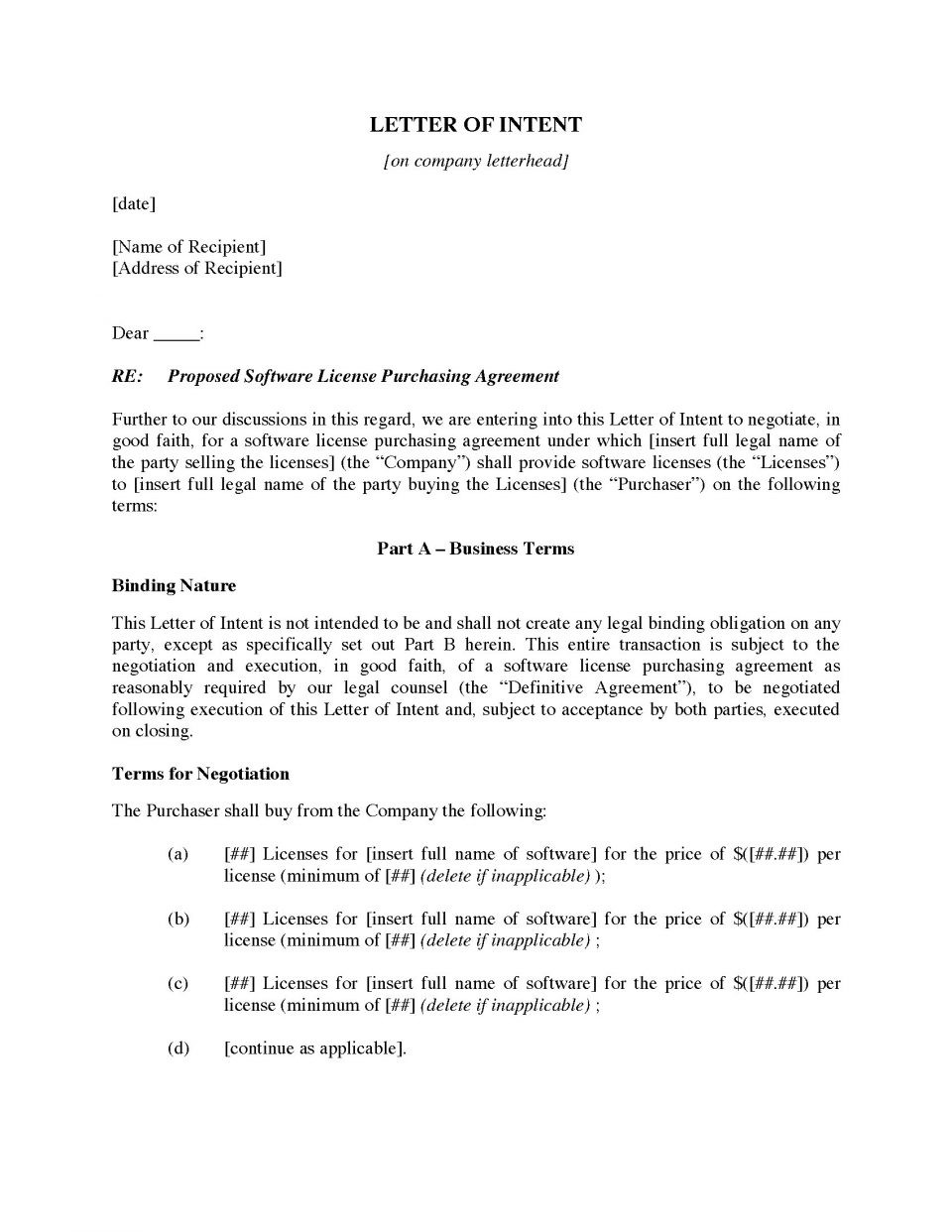

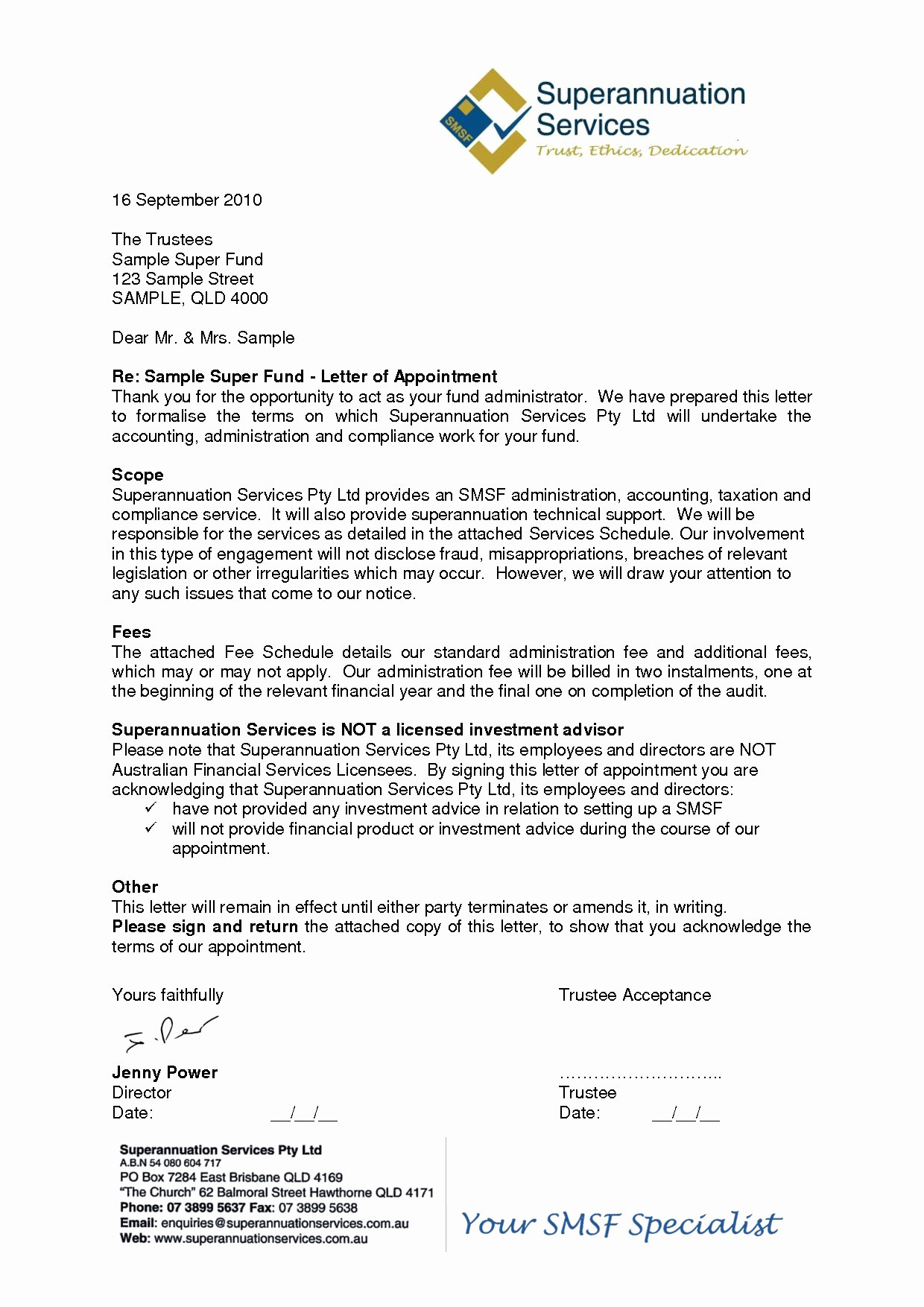

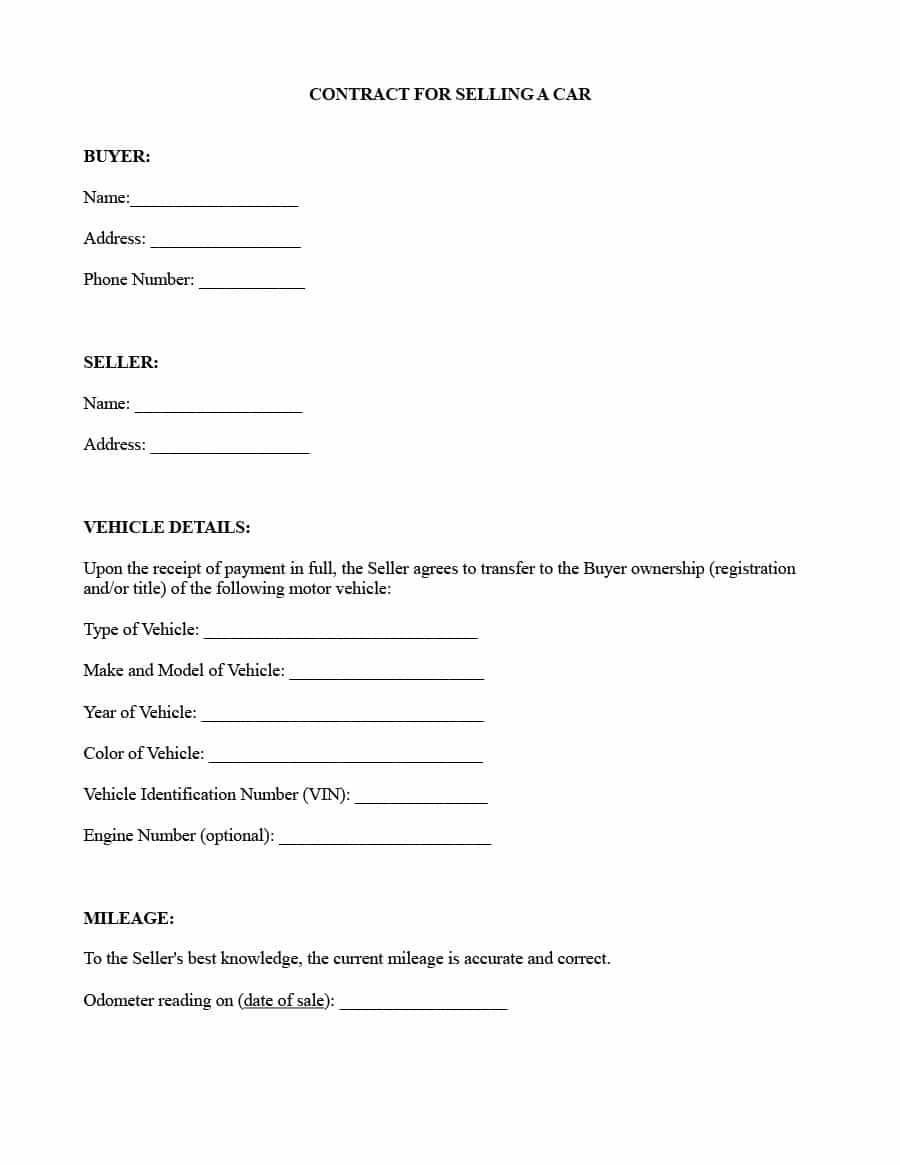

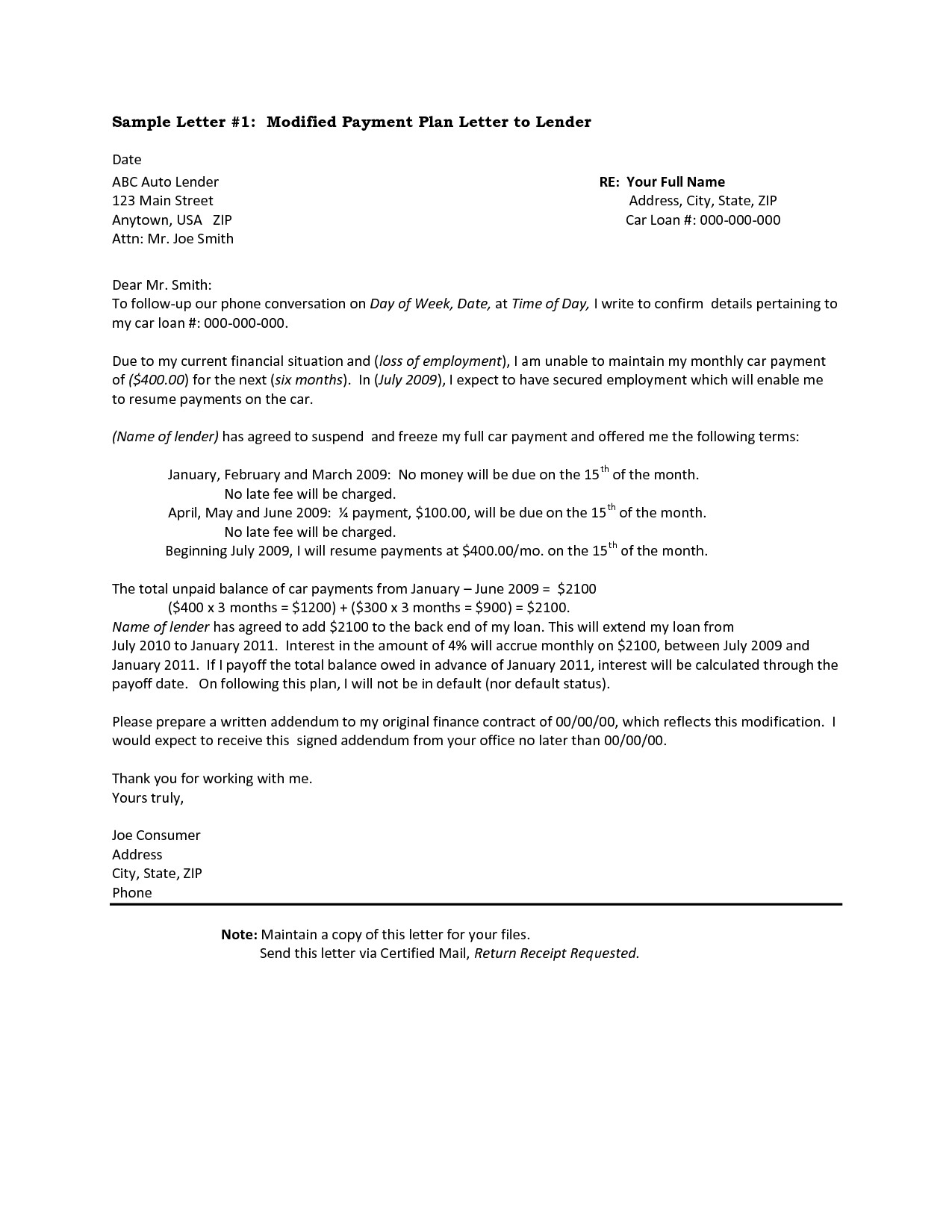

A car repossession letter template is very important in these cases. Many people do not realize that there is such a thing, and the lender may be using it against you in order to get you to pay up. The first thing that the lender will ask for in this letter is the amount that you owe. They will then ask you to supply information about the car, as well as information about the person who actually owns the car.

If you cannot provide the information that the lender requires, then the letter will state that you cannot make payment for the particular car that you are trying to repossess. They will then tell you that you have a number of options available to you, and they will show pictures of what they are claiming is owed to them. If the loan was taken out before they foreclosed on your vehicle, the lenders may also ask you for information regarding your employment, where you work, and if you have filed bankruptcy.

This part of the letter is critical, because it will show the lender that you have a part of the responsibility to make payments. to the situation, and that you should be aware of the information that they are asking for.